If you don’t want to throw your money away, you should start with a thorough analysis of the crypto market. It’s the same as in ordinary trading – you apply fundamental and technical analysis.

Fundamental Analysis

This method is often used for analyzing some particular type of kinoin, in order to find out how reliable it is, what possibilities and prospects it has, and how many people use it.

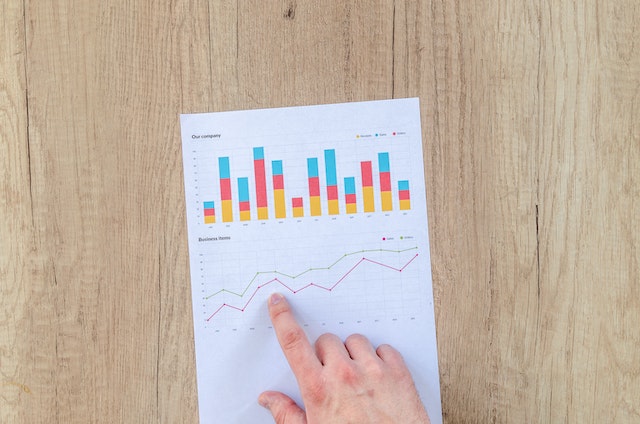

Fundamental analysis helps to understand better the object of investment, and technical – how the quotes will behave

For example, if you want to invest in new promising cryptocurrency projects, you need to start by evaluating several factors.

Project plan. Find out if this new cryptocurrency has a plan of action and in what direction it will develop. Websites of such platforms usually have documents that can provide answers.

Who is behind the development. The team is almost the most important factor influencing the success of an electronic asset. If the people behind the code are experienced, understanding, with a long-term plan and all the necessary resources for its implementation – the chances of failure are minimal.

When researching a particular type of cocaine try to collect as much information about it as possible from various sources and, if possible, ask the opinion of real people who have dealt with it. This way you minimize the risks of running into a fraudulent scheme or just a “soap bubble”.

Also, when choosing an asset for financial investments, you will have to decide on its type. Among the most profitable types of cryptocurrencies are:

Bitcoin and its “forks.” That is, bitcoins based on bitcoin.

Alcoins. They work on other platforms and often have interesting and promising features, which are also worth considering when investing.

Stablecoins. Quotes for this type of e-currency are tied to economic assets. For example, the U.S. dollar.

Tokens. Cryptocurrencies are not cryptocurrencies, because they do not have their own cryptoplatforms. But you can invest in them, too.

Technical Analysis

With technical analysis, you can study the quotations of electronic currencies at different time intervals. Most of the value prediction techniques are applicable to stable markets that have been around for more than 10 years. Since the cryptocurrency market is relatively “fresh” and has high volatility, most of the technical analysis techniques are not suitable in this case.

Therefore, it is better to focus on the fundamental part of the analysis to understand more clearly what you are investing in. But it is still necessary to follow the quotes during the day.